[ad_1]

<!–

–>

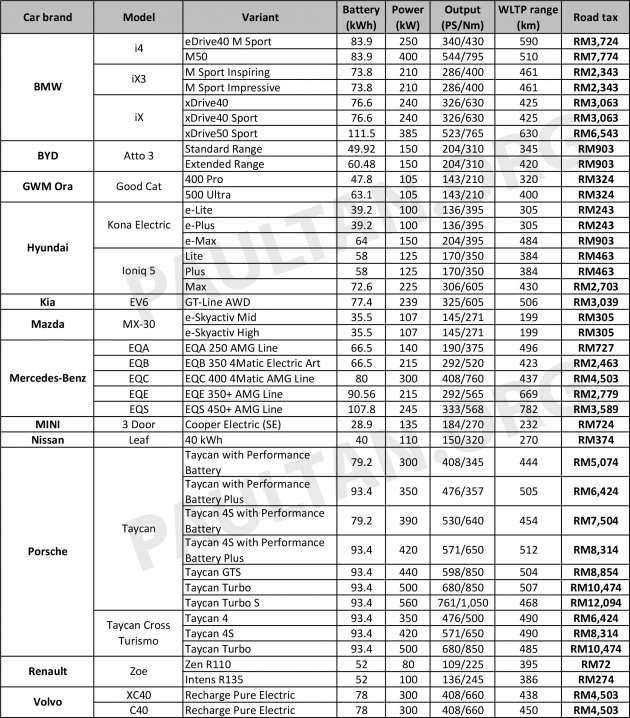

Road tax for EVs is free in Malaysia, but only until end-2025 – here’s how much you’d pay from 2026 onwards

Thanks to incentives put in place by the government, electric vehicles (EVs) are currently exempted from road tax from January 1, 2022 until December 31, 2025. Of course, all good things can come to an end, and while current owners will not need to pay road tax for a few more years, they (and future owners) will need to be prepared to pay from 2026 onwards.

We’ve covered the topic of road tax for EVs in the past, but with a lot more EVs now on sale in Malaysia, we’ve done the math so you know how much the road transport department (JPJ) will charge. The calculations guidelines have been around for some time now – we covered it in 2019 – and it’s worth repeating how they work.

While vehicles with internal combustion engines have their road tax calculated based on engine capacity, EVs follow a kilowatt-based system. The final road tax amount for an EV is calculated based on the total power rating of the electric motor(s), with different power brackets determining the base rate and accompanying progressive rate (if applicable).

Road tax for EVs in Malaysia; click to enlarge

At its most basic, EVs that are considered as private saloon motorcars – individual (code AB) and company registration (AC) – with a rated output of 80 kW and below have the following rates:

- 50 kW and below – RM20

- Above 50 kW to 60 kW – RM44

- Above 60 kW to 70 kW – RM56

- Above 70 kW to 80 kW – RM72

Beyond 80 kW, the road tax amount consists of two parts: a base rate plus a progressive rate. This is where most EVs in the market typically reside, and the rates are as follows:

- Above 80 kW to 90 kW – RM160 base rate with RM0.32 sen added for every 0.05 kW (50 watt) increase from 80 kW

- Above 90 kW to 100 kW – RM224 base rate, and RM0.25 sen added for every 0.05 kW (50 watt) increase from 90 kW

- Above 100 kW to 125 kW – RM274 base rate, and RM0.50 sen added for every 0.05 kW (50 watt) increase from 100 kW

- Above 125 kW to 150 kW – RM524 base rate, and RM1.00 added for every 0.05 kW (50 watt) increase from 125 kW

- Above 150 kW – RM1,024 base rate, and RM1.35 added for every 0.05 kW (50 watt) increase from 150 kW

JPJ EV road tax calculation guidelines; click to enlarge

Now, the department also has separate categories for private vehicles aside from saloon motorcars (such as SUVs) – individual (code AD) and company registration (AE). These follow the same power brackets as private saloon motorcars, but with different rates.

For private vehicles that are not saloon motorcars with a motor power rating of under 80 kW, the rates are as follows:

- 50 kW and below – RM20

- Above 50 kW to 60 kW – RM42.50

- Above 60 kW to 70 kW – RM50

- Above 70 kW to 80 kW – RM60

As for EVs with a motor power rating beyond 80 kW, the calculation is based on the following rates:

- Above 80 kW to 90 kW – RM165, and RM0.17 sen for every 0.05 kW (50 watt) increase from 80 kW

- Above 90 kW to 100 kW – RM199, and RM0.22 sen for every 0.05 kW (50 watt) increase from 90 kW

- Above 100 kW to 125 kW – RM243, and RM0.44 sen for every 0.05 kW (50 watt) increase from 100 kW

- Above 125 kW to 150 kW – RM463, and RM0.88 sen for every 0.05 kW (50 watt) increase from 125 kW

- Above 150 kW – RM903, and RM1.20 for every 0.05 kW (50 watt) increase from 150 kW

You’ll notice that the rates for fully electric non-saloon private vehicles (SUVs or jip as JPJ would classify them) are generally lower in most brackets, and this is also true of ICE cars too. In any case, the general rule is the higher the power output of an EV, the more road tax you’ll be paying.

It’s clear that EV owners will be paying quite a bit in road tax once the exemption ends when compared to owners of ICE cars. For some context, let’s compare an EV and ICE crossover (in the SUV or jip category) that are priced relatively similar.

We’ll use the BYD Atto 3 crossover, which, in its base Standard Range variant retails for RM149,800 on-the-road without insurance and has a road tax of RM903 – the latter also applies to the top-spec Extended Range. Meanwhile, a HR-V in e:HEV RS guise with a 1.5 litre naturally-aspirated engine is priced at RM140,800, which is RM9,000 less, but the applicable road tax is 10 times less at just RM90.

Here’s another example with vehicles from the same brand. The Volvo XC40 as a full EV (Recharge Pure Electric) is priced at RM278,888 and its generous output of 300 kW means the road tax charge is a whopping RM4,503. The same SUV with a 1.5 litre plug-in hybrid powertrain is priced at RM268,888, but the road tax is also RM90, or 50 times less! If you bring in the 2.0 litre mild hybrid variant into the picture that sells for the same amount, the road tax goes up to RM380, which is still considerably less.

Based on our table, the EV with the cheapest road tax is the Renault Zoe Zen R110, which has a power output of 80 kW that entails a flat rate of just RM72. The more powerful Intens R135 has a road tax charge nearly four times more as it has an output of 100 kW that puts it into a different bracket.

The Hyundai Kona Electric is second cheapest, with a road tax of RM243 applicable to the two variants priced below the RM200,000 mark, namely the e-Lite and e-Plus. Being a crossover, the Kona Electric would fit into the ‘private vehicles aside from saloon motorcars’ category, so it benefits from a lower progressive rate.

Other EVs with a three-digit road tax charge are the GWM Ora Good Cat (RM324), the Nissan Leaf (RM374), the Lite and Plus variants of the Ioniq 5 (RM463), the Mazda MX-30 (RM305), the Mercedes-Benz EQA (RM727) and the MINI Cooper Electric (RM724).

With EVs that have substantially higher outputs, the road tax charge goes as high as RM12,094 (as is the case for the Porsche Taycan Turbo S), which is the amount you would pay for a Lamborghini Huracan with a 5.2 litre V10.

Looking at the figures, we can’t help but consider the road tax calculation guidelines for EVs to be a little unfair. If the goal is to make EVs affordable for the masses, it’s not just the purchase price that needs to be considered, but also the cost of ownership in relation to road tax. Existing EV owners have voiced their concerns on the matter and called on the government to revamp the system in order to promote EV adoption.

However, it has to be said that in terms of pricing and affordability, EVs already have a massive advantage here in Malaysia by being virtually tax free to buy to begin with. Having to pay a slightly hefty road tax later on after a few years of free running seems fair enough, some would argue, especially taking into account the level of performance and the considerable weight of most EVs.

What are your thoughts on the matter? Should the road tax calculation guidelines for EVs be revised or are they fine as is? Get the discussion going in the comments below.

Yes, the current calculations for lesen kenderaan motor (LKM) EV is manifestly unfair & a deterrent to EV adoption.

We believe YB @anthonyloke can take this opportunity for a thorough revamp, and consider a “clean sheet” approach

— Malaysian EV Owners Club (MyEVOC) (@ev_club) January 26, 2023

GALLERY: JPJ road tax calculation guidelines for EVs in Malaysia

<!–

–>

Previous Post: Hyundai Ioniq 5 Max 2023 pasaran M’sia dipertingkat dengan HUD, tiada lagi bumbung solar, bateri sama

Next Post: Volvo panggil semula 545 unit kereta di Malaysia berhubung masalah perisian pada modul kawalan brek

[ad_2]

阅读更多